Our Process

A Clear Path to Your Confidence

Our Process

Our process begins with education and ensures that every decision we make is informed, transparent, implemented and centered around you. Let us help you build a secure and prosperous financial future tailored to your unique needs.

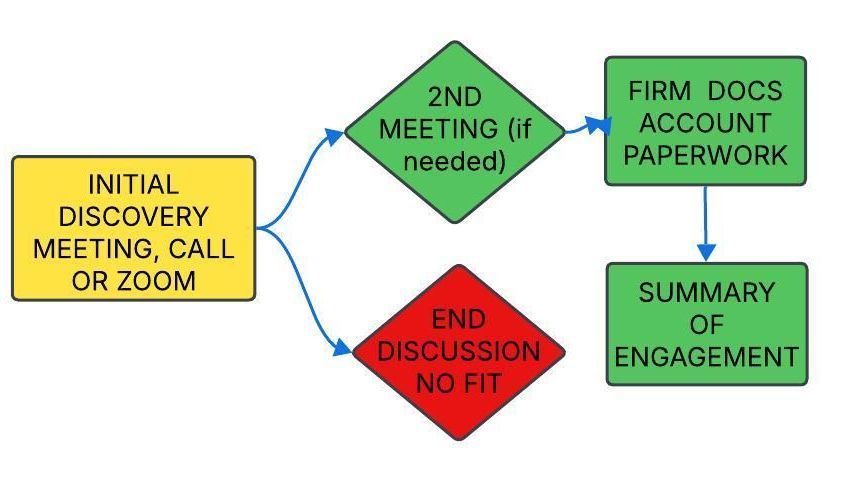

1. Discovery Step

If you’re reading this, you’ve probably joined us for an in-person session, a Zoom class, or watched one of our lessons on YouTube. With the knowledge gained from these free resources, you are already one step ahead in the path to a secure financial plan.

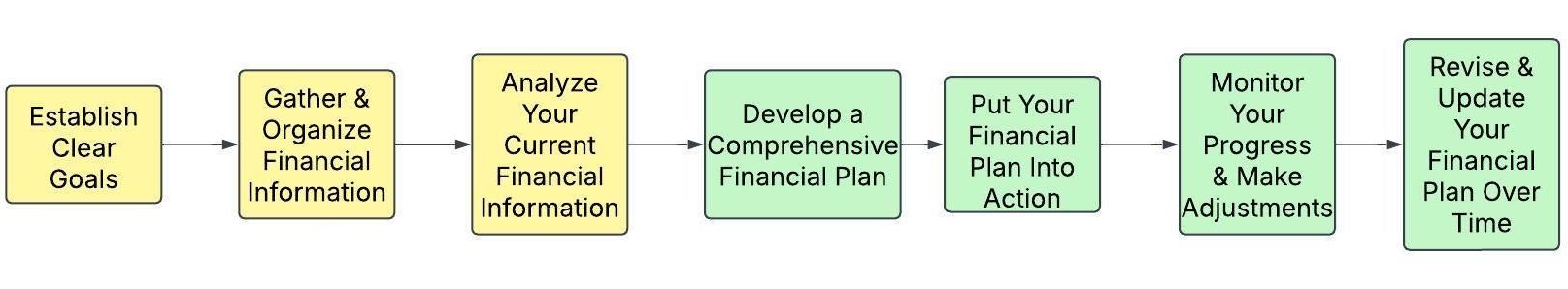

2. Financial Planning Step

Simply put, our financial planning process is efficiently managing your money and

achieving personal, economic and financial satisfaction. This process also allows you to

take control of your financial situation. Determining the suitable courses of action to

achieve your financial objectives is what it’s all about when it comes to planning.

A financial plan should thoroughly detail your entire financial situation. We aim to

work with you to build a financial plan using a wholistic approach. A holistic approach

includes reviewing your current financial situation, investments, and short-term and

long-term financial goals. We will look at how you currently spend your money, help you

organize your finances and help you with an investment plan. We may even help you

with some of our other services such as college planning or an estate plan when the

time comes.

We will try to make the financial planning process less cumbersome and overwhelming.

We can help you with small financial decisions and the large ones like saving for

retirement and investment planning.

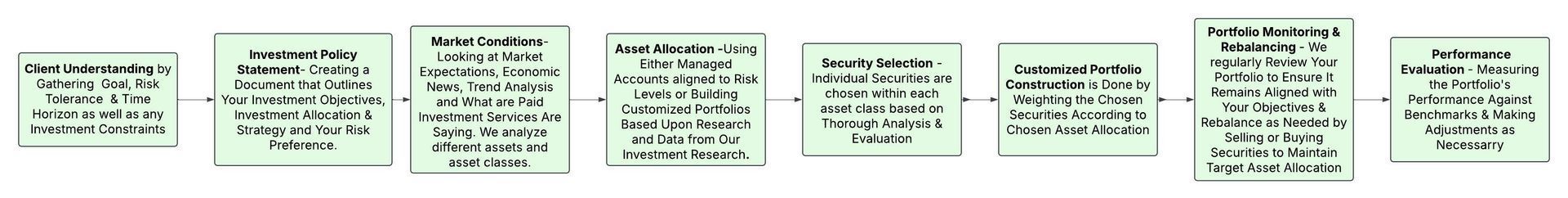

3. Investment Advisory Phase Step

We believe you need a financial plan, and your financial goals defined before we deal

with your investments. Our investment advisor process has multiple steps designed to

integrate your goals and your financial plan with your desired risk preference.

We offer a wide array of investment products and will work with you to build a portfolio

that has the greatest probability of achieving your goals.

Upon portfolio completion, we will continue to monitor your holdings and report to you.

We also will regularly check in with you to confirm your satisfaction level and to adjust

your portfolio accordingly.

4. Communicating With You Step

We believe you need a financial plan, and your financial goals defined before we deal

with your investments. Our investment advisor process has multiple steps designed to

integrate your goals and your financial plan with your desired risk preference.

We offer a wide array of investment products and will work with you to build a portfolio

that has the greatest probability of achieving your goals.

Upon portfolio completion, we will continue to monitor your holdings and report to you.

We also will regularly check in with you to confirm your satisfaction level and to adjust

your portfolio accordingly.

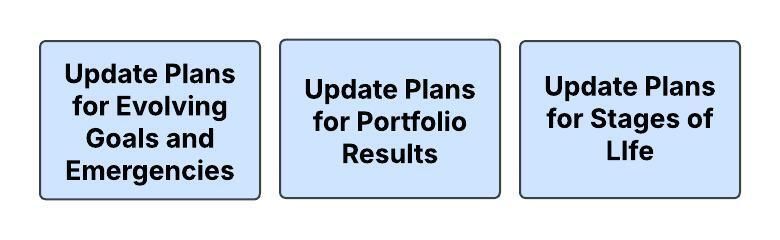

5. Planning Over Time Step

Overtime, age, life events, health issues and more make it imperative that we keep your

financial plan and investment portfolio up to date. We will always have an open line of

communication with you, offering meetings, calls and more to understand what is new

and to share update results with you.

Ultimately, this process serves as the foundation for a long-term, dynamic financial

relationship